The short-seller assault on AppLovin is getting ratcheted up a notch.

A week after Fuzzy Panda Research put out a report alleging that AppLovin’s ad-tech software is the “nexus of a house of cards,” and accusing the company of violating Google and Apple’s app store policies, the short-seller firm is urging the S&P Index Committee to keep AppLovin’s stock out of the benchmark index.

“We are writing to the committee regarding very serious allegations that have been raised against a company that will potentially be added to the S&P 500, AppLovin (APP),” Fuzzy Panda wrote in a March 4 letter to the committee, which is responsible for making quarterly changes to the index. CNBC viewed a copy of the letter.

Representatives from AppLovin and S&P declined to comment.

Fuzzy Panda’s case against AppLovin comes after the company’s share price soared more than 700% in 2024, lifting its market cap past $110 billion. The historic rally made AppLovin a prime candidate for inclusion in the S&P 500, whose median market cap is about $36 billion. However, after the stock was left out of the index in the most recent change in December, AppLovin plunged 15%.

Cloud software vendor Workday was added in December, even though it was valued at tens of billions of dollars less than AppLovin. Workday shares rallied 5% on the news. Stocks often rise when they get included in the index, because fund managers that track the widely followed benchmark have to buy shares.

The next quarterly rebalancing, which involves the index committee’s changes to the S&P 500, is expected later in March. As a short seller, Fuzzy Panda is betting on a drop in AppLovin’s stock price, and stands to profit if it declines further.

In its letter, Fuzzy Panda said AppLovin doesn’t meet the S&P 500’s “gold standard.” Last week, Fuzzy Panda was one of two firms, along with short-seller Culper Research, that critiqued AppLovin’s AXON software, the driver of the company’s earnings growth and the stock surge. The shares dropped 12% on Feb. 26, the day of the short reports.

Culper didn’t respond to a request for comment.

AppLovin released the updated 2.0 version of AXON in 2023. The company says the technology, powered by advanced artificial intelligence, helps put more targeted ads within apps, particularly mobile games, and that it’s been expanding to help e-commerce companies with their promotions.

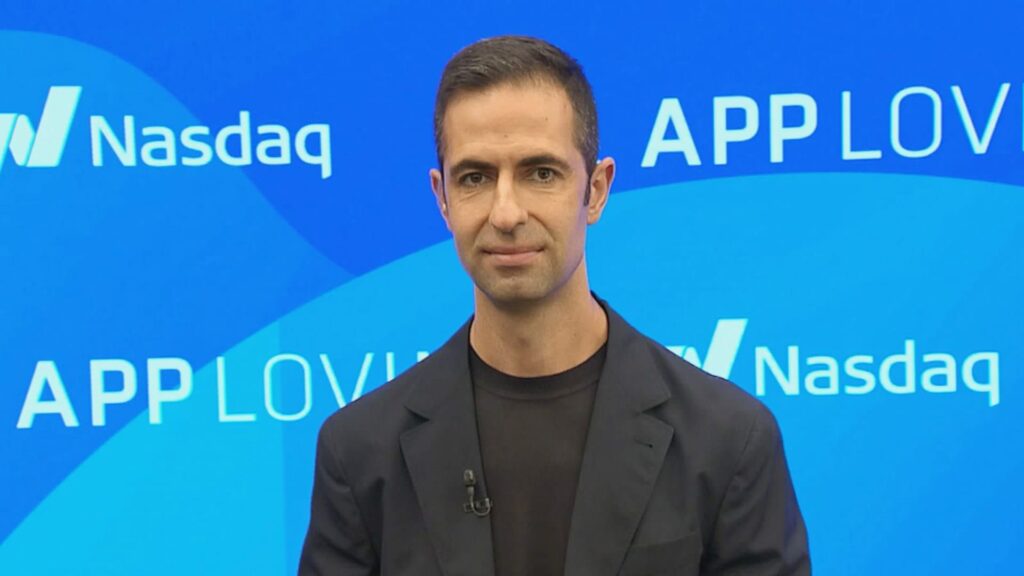

Following the reports from Fuzzy Panda and Culper, AppLovin CEO Adam Foroughi wrote in a blog post that the notes were “littered with inaccuracies and false assertions.”

“It’s disappointing that a few nefarious short-sellers are making false and misleading claims aimed at undermining our success, and driving down our stock price for their own financial gain, rather than acknowledging the sophisticated AI models our team has built to enhance advertising for our partners,” Foroughi wrote. “It’s also noteworthy that the short reports emerged after our earnings report, where we would be in a period of being unable to respond with financial performance.”

AppLovin reported an earnings beat earlier in February, sending the stock up 34% in two days and past $500 for the first time. Since then, the stock is down almost 50%, plummeting significantly more than the broader market, after dropping 18% on Thursday.

Multiple Wall Street analysts agreed with Foroughi’s assessment.

“We believe most of the issues that have been highlighted recently have almost no merit,” analysts at BTIG wrote in a Feb. 26 note, reiterating their buy rating.

Analysts at Piper also kept their buy recommendation and said they were “buyers of APP following the selloff.”

“APP’s customers are the most sophisticated in digital advertising & we believe any alleged fraudulent practice would be felt immediately via their own attribution or incrementality testing,” they wrote.

Fuzzy Panda’s letter to the S&P committee reiterated its earlier allegations of fraudulent ad tactics, such as AppLovin’s alleged stealing of data from Meta in its e-commerce push and its tracking of children’s devices, violating Apple and Google’s rules. CNBC has not been able to independently verify Fuzzy Panda’s allegations.

Fuzzy Panda said its research consisted of interviews with former employees at AppLovin and Meta, industry experts and executives at other ad-tech companies as well as its own analysis and testing of the technology.

“AppLovin’s recent revenue growth has been based in data theft, revenue fraud, and the exploitation of our country’s laws protecting children,” the firm wrote to the S&P committee.

In its earlier report on its short position, Fuzzy Panda wrote, “AppLovin has been playing a dangerous game and is risking a permanent ban from the duopoly mobile app store platforms that controls the gateway to >99% of the market.”

Representatives from Meta, Apple and Google didn’t provide comments.

According to Fuzzy Panda’s website, the firm has taken on about 20 companies, including electric car makers Fisker and Lucid, insurer Globe Life and online education company Stride.

Globe Life shares plummeted more than 50% in April after Fuzzy Panda, in revealing its short position, said it had uncovered numerous instances of insurance fraud. Globe life responded by calling the report “wildly misleading” and “driven solely by short-term profit” from short sellers.

WATCH: AppLovin soars almost 30% on earnings, guidance beat