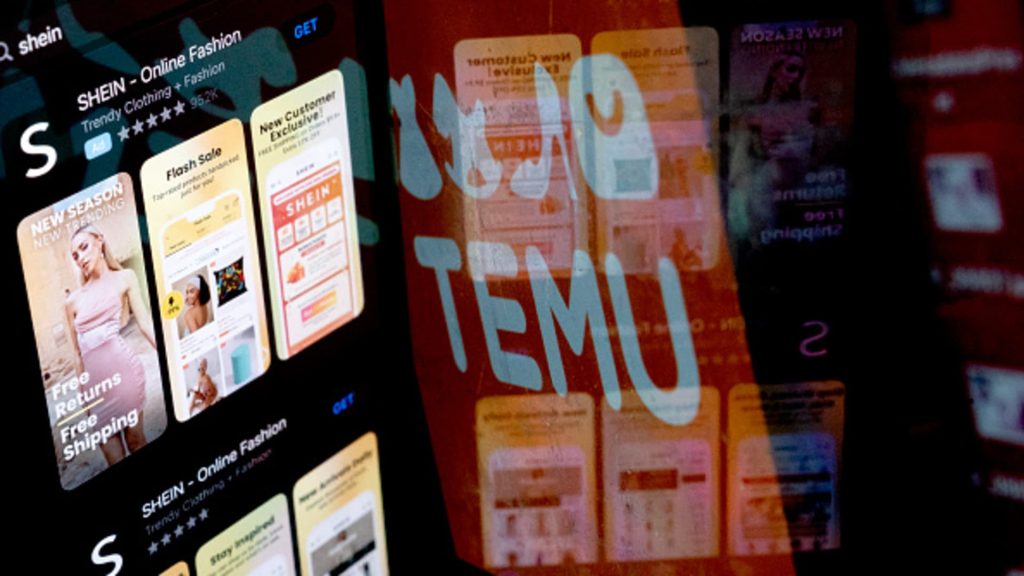

Stefani Reynolds | Afp | Getty Images

The closure of a trade loophole and prohibitive tariffs on China have upended Temu and Shein’s business model in the United States. And yet the e-commerce companies are likely to remain a dominant force in American online retailing, experts suggest.

On Friday, the de minimis rule — a policy that had exempted U.S. imports worth $800 from trade tariffs — officially closed for shipments from China. This has seen Temu and Shein exposed to duties as high as 120% or a flat fee of $100, set to rise to $200 in June.

The small-package tariff exemption had been key to the companies’ ability to maintain budget prices on the merchandise they shipped from China. In the lead-up to its removal, prices of goods shipped directly from China on Temu and Shein surged, with Temu later ending direct shipments from outside the U.S. altogether.

The change will be welcomed by many detractors of de minimis, among them U.S. lawmakers, labor unions and retailers, who have argued that Temu and Shein abused the exemption to undercut local businesses and flood the country with illicit and counterfeit products.

But despite the new trade challenges that Temu and Shein face, e-commerce and supply chain experts told CNBC that the companies are still capable of competing with their rivals in the U.S.

“Don’t count them out … Not at all. These kinds of Chinese e-commerce apps are very adept and agile. They have contingency plans in place and have taken the necessary steps to cover the tariffs from a margin perspective,” said Deborah Weinswig, CEO and founder of Coresight Research.

“I personally believe, if anything, [America’s e-commerce] game has been accelerating in favor of Temu and Shein … I wouldn’t be surprised if the competitiveness gap actually continues to widen,” added Weinswig, whose research and advisory firm works with clients across tech, retail and supply chains.

Contingencies in place

The loss of the de minimis exemption had long been anticipated, with U.S. President Donald Trump temporarily closing it in February. In preparation, Temu and Shein had been accelerating localization strategies for the U.S.

Scott Miller, CEO of e-commerce consulting firm pdPlus, told CNBC that Shein and Temu will continue to onboard goods from American sellers onto their apps to protect them from tariffs.

“Many of the current sellers on Temu and Shein are located in China or countries nearby, but not all. Local U.S. companies have been joining these platforms at an accelerating pace … several of our clients have onboarded or began the process of onboarding in just the past few months,” he said.

While margins for more localized brands and sellers will be lower on the platforms than those shipping directly from China, they can be competitive, according to Miller.

He added that in the case of Temu, vendors are attracted to lower fees, lighter competition and greater assistance with onboarding and setting up sales channels compared with what Amazon offers.

In recent days, Temu, which is owned by Chinese e-commerce giant PDD Holdings, has begun exclusively offering goods shipped from local warehouses to U.S. shoppers.

Many of those goods are still sourced from China but then shipped in bulk to U.S. warehouses, according to experts. While these bulk items are subject to tariffs, they also benefit from economies of scale.

This development is likely to see the variety of products on Temu scaled back, said Henry Jin, an associate professor of supply chain management at Miami University. However, he added, Temu is likely to resume direct shipments from China, depending on the outcome of the trade war between Washington and Beijing.

Shein, meanwhile, has leaned into supply chain expansion, building manufacturing operations in countries such as Turkey, Mexico and Brazil, and reportedly plans to shift to Vietnam.

The company appears to still be shipping directly from China and likely has more room to absorb tariffs because of its “sky-high” margins in its core fast-fashion business, Jin said.

“If there’s one thing that Chinese companies are good at, it’s operating on a razor thin margin in an intensely competitive, if not adverse environment … they find every scrap that they can to survive,” he added.

Competitive prices?

Contingency plans aside, experts said that Trump’s trade policy will likely continue to fuel higher prices for goods on Temu and Shein’s apps.

Prices across different shopping categories on Shein rose between 5% and 50% in the latter half of April, with the sharpest rises seen in toys and games and beauty and health, according to data from Coresight.

Regardless, many e-commerce experts remain confident that Temu and Shein will continue to prove price-competitive.

Temu, which had increased prices of orders shipped directly from China, told CNBC on Tuesday that “pricing for U.S. consumers remains unchanged as the platform transitions to a local fulfillment model.”

Coresight’s Weinswig said the two companies have previously been able to offer products at a third of the prices on Amazon for comparable goods. So, even if they more than double the prices to absorb the impacts of tariffs, many goods could remain cheaper than those on American e-commerce sites and retailers.

Jason Wong, who works in product logistics for Temu in Hong Kong, noted this dynamic when speaking to CNBC last month, likening Temu to a dollar store. If prices at the dollar store go from $1 to $2, it’s still a dollar store, he said.

Furthermore, Trump’s trade tariffs on China and other trade partners have also affected American retailers and e-commerce sites like Amazon.

Other advantages

When Forever 21 filed for bankruptcy protection earlier this year, it blamed Shein and Temu’s use of the de minimis exemption, which it said “undercut” its business.

But experts say that exclusively attributing the success of Shein and Temu to that trade loophole misses many of the other factors that have made them smash hits in the U.S.

According to Anand Kumar, associate director of research at Coresight Research, Temu and Shein owe a lot of their success to their very agile supply chains that adapt fast to consumer trends.

For example, Shein’s small-batch production — in which product styles are initially launched in limited quantities, typically around 100-200 items — allows it to test and scale products efficiently.

Another key is the companies’ applications, which use various strategies to maintain user interest, including frequent phone notifications, product recommendation algorithms and perhaps most notably, constantly displaying discounted prices from promotions and flash sales.

Temu was offering a “mega savings extravaganza” for American consumers on Monday. Some of the bestselling items on sale included stainless steel hook earrings for $1.45 and a fitted mattress pad for $11.54. It’s unclear if the discounted local goods were stockpiled before tariffs came into effect.

In addition, app users will often be met with mini-games that grant different coupons or ways to earn rewards, as well as opportunities to buy “mystery boxes” with assorted products.

That “gamification strategy” definitely plays into the consumer psychology of many U.S. shoppers who often buy items out of the excitement of being able to get a great deal, said Miami University’s Jin.

Experts also flagged that Temu and Shein have been very effective at marketing, including through the harnessing of livestreaming and social media.

On the other hand, according to Coresights’ Weinswig, American retailers have failed to adequately recognize threats from Temu and Shein and adjust their supply chains and pricing models.